The Federal Inland Revenue Service (FIRS) says it expects to capture at least 500,000 new corporate accounts in its tax database by March 31, 2016.

The Chairman of FIRS, Mr Babatunde Fowler, told State House correspondents in Abuja on Friday that the objective was to ensure timely collection of revenue on behalf of the Federal Government.

Fowler said that the exercise would add to the 105,000 corporate accounts in the agency’s database.

“There is a big gap both on the terms of the individuals and also the corporate.

“On the corporate side, we expect we are going to

register at least half a million new corporate accounts by March 31.

“We have started the campaign and in the last 45 days we have registered nearly 105,000 corporate accounts that have not been paying tax.

“So I think it is time that we all put hands together and try and make sure that we support ourselves in supporting government so that government has the required revenue.

“So the government can provide the services and the required infrastructure to make Nigeria the Nigeria of our dreams.’’

The chairman of the service said that the level of compliance with individual tax payment was low.

He stated that at least 27 million Nigerians do not pay tax.

“In terms of individuals it is still very low. I was at a meeting with the chairman of the SMEs and rightly so, he said that he employed close to 34 million individuals in that business.

“And as you know the SMEs are very important when it comes to economic growth.

“They provide employment, they also provide products that all of us use from toothpicks to matches and all that.

“But the irony of that is that if they have 34 million or 35 million members, on our national tax data base you have less than Seven million individuals.

“So the issue here is that we have close to 27 million individuals who are not registered, who are not paying their taxes.’’

He stressed the need for the nation to save for a rainy day.

“We have to be ready to save for that rainy day to make sure that we as a government and also as individuals put something aside,’’ he said.

-

500,000 new corporate accounts in tax database by March 2016 - FIRS

10:49:00 0

500,000 new corporate accounts in tax database by March 2016 - FIRSdestiny igbinedion 10:49:00

destiny igbinedion

Integer sodales turpis id sapien bibendum, ac tempor quam dignissim. Mauris feugiat lobortis dignissim. Aliquam facilisis, velit sit amet sagittis laoreet, urna risus porta nisi, nec fringilla diam leo quis purus.

You might also like

Subscribe to:

Post Comments

(

Atom

)

Powered by Blogger.

CONTACT US

For enquiries and advert placement call this number

08163154395

Our mata na your mata

08163154395

Our mata na your mata

MOBILE TV

VENATUS FOOTBALL COMPETITION

So you think you can play

Contact Form

Advert

OUR MATA

ACCESS MAVIN

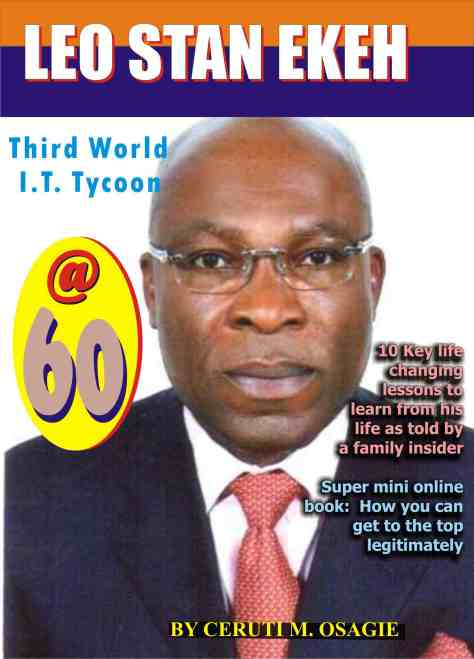

Grab a Copy here

A must read

CLICK HERE

ITS TIME TO PARTY

Yummy

HEALTH

Blogger news

THE FOF FOUNDATION

Blogroll

About

Popular Posts

-

Photo Gallery by QuickGallery.com >

-

2 baba as he is fondly called decided it was time to speak up on his progress in the music industry. I wouldnt have been anywhere were it ...

-

Like the old adage says Soup wey sweet na money kill am , Minister of Power, Works and Housing Mr. Babatunde Fashola said for NIgerians to...

No comments:

Post a Comment